Should I pay off my Student Loans?

If you’re a student in the UK you might be a little confused as to how you pay them back. How much do I pay? Should I pay early? Do I get a choice? Let’s clear this up.

I have gotten all of the following information from the UK government website. (15/12/21)

***

Loans

There are 3 types of loans to pay back:

Tuition Fee Loans

Maintenance Loans

Postgraduate Loans

Most of us will have the first 2: Tuition Fee Loans and Maintenance Loans. The postgraduate loans only apply if you study at the postgraduate level.

Plans

When you start repaying your loan and how much you pay depends on which repayment plan you’re on. The plans are:

Plan 1

Plan 2

Plan 4

Postgraduate Loan

Click here for more information on these plans

Plan 2

In this article I will be focusing on Plan 2:

This is the plan that I am on and the plan that will be most relevant to my readers.

Threshold

On Plan 2, the thresholds are:

What this means:

You don’t pay back any money unless you earn above: £524 a week or £2,274 a month. (Which is £27,288 a year.)

If you do earn above this amount: You will pay 9% of any amount above the threshold.

~From now, we’ll assume that we’re not dealing with postgraduate loans. This makes the maths easier. (Don’t worry, if you do have postgraduate loans, you will be able to apply the same principal to that too.)~

Here’s a diagram:

Person A doesn’t earn above the threshold of £524, so they pay nothing. Person B does earn above £524, so he pays 9% of anything above that line. If we zoom in a little, we can see exactly what’s going on:

That tiny red portion is the part that person B pays. Of the £600 a week that person B earns, he pays £6 a week. The same applies across periods of months and years. Obviously the more you earn the more you pay.

After 30 Years

Plan 2 loans are written off 30 years after the April you were first due to repay. (Your debt is erased after 30 years.)

Interest

Your loan grows due to interest while you study and while you work. While you’re studying the interest rate is 4.1% per year.

After that, your interest rate depends on your income in the current tax year:

For the sake of simplicity, we shall go with 4.5% per year.

***

My Loans

With all that set-up out of the way, we can get down to some real calculations.

Here are the rough estimates for what I might have to pay.

Should I pay early?

The two options we are presented with are to:

wait (for the student loan to pay itself off)

pay early (paying all of my student loans in full as soon as I finish studying)

This all depends on two factors: ‘How much do I owe?’ and ‘How much do I earn?’

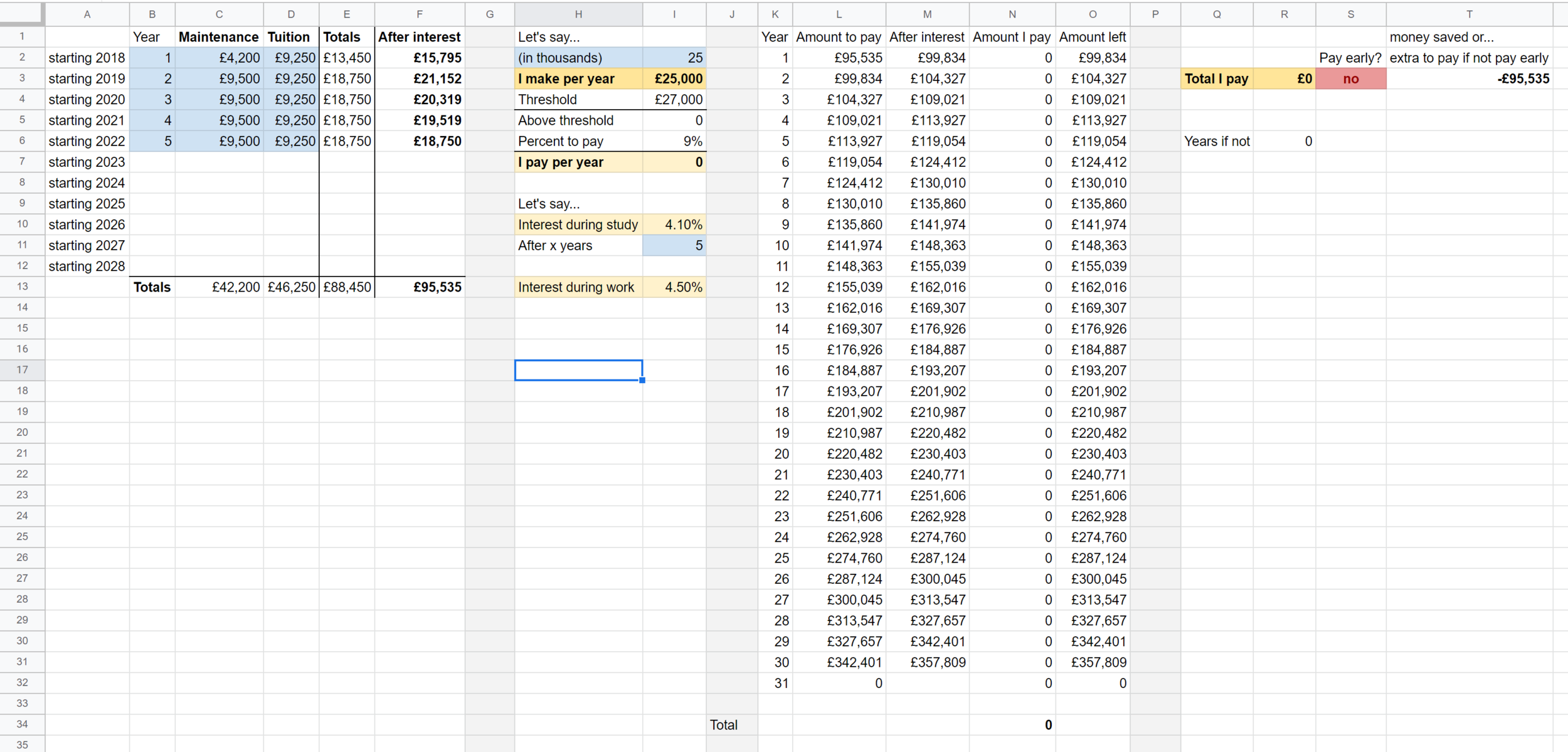

I created an excel spreadsheet to calculate whether I should pay my loan early depending on how much I make. Here is that spreadsheet:

Assuming I earn £100K

What I owe after I graduate is summarised on the left of column G.

In columns H and I have stored key information for calculations including: how much I make per year, threshold and interest rates.

Between column J and column P, I calculate how much I have left to pay each year.

Beyond column P, I display the total amount I end up paying and how far above or below the original amount it is. If this is above the original amount, the ‘pay early?’ box will display ‘yes’. If not, it will display ‘no’.

Assumptions

I have made the following assumptions:

I will make the same amount per year for the rest of my life.

The interest rates will stay the same.

‘Paying early’ means paying all of my student loans in full as soon as I finish studying.

Analysis

If you didn’t know: K means 1000 of something. £100K = £100,000. In that screenshot, I assume that I will earn £100K a year. If I wait for that to pay itself off, I will end up paying £158,581 which is £63,046 more than if I paid early. (You can see this in the top right corner.)

I pay less if I pay early. So, I should not wait, I should pay early.

Let’s see some more examples: (I’ll keep the amount I owe the same.)

£25K

In this case, I do not earn above the threshold, so I do not have to pay back a single penny of what I owe. So, I should not pay early, I should wait.

If I wait, the money I save is £95,535.

£50K

Here, I earn only a little above the threshold. It adds up so that over the 30 years, I pay in total an amount that is less than what I originally owed. (After this, my debt it wiped.) Therefore there is no advantage in me paying off my student loan early. I should not pay early, I should wait and let it pay itself off.

If I wait, the money I save is £33,435.

Another interesting thing we see is that the amount I owe keeps increasing even though I am paying off part of it. This is because the increase due to interest is greater than the amount I pay off each year.

£63K

As we keep going up, £63K is the first point at which paying off my student loan early will save me money. - If I wait for it to pay itself off, the total amount I end up paying back is more than what I owe. The less total you owe, the lower this point comes. I should not wait, I should pay early.

If I wait, I pay £1,665 extra.

- Please note: this point will be different for you! It depends on how much you owe!

92K

As we keep going up, £92K is the point at which I pay the most (if I let the student loan pay itself off.) If I earn any higher and I actually end up paying less! (We’ll see why in a moment.) I should not wait, I should pay early.

If I wait, I pay £79,965 extra.

- Again, please note: This will be different for you!

250K

At this point, we start to see why the numbers go down. - I pay the loan off in less time. We saw a little bit of this in the 100K example - we paid off the loan in year 25. We see here, with 250K, that the loan is paid off in year 6. Still, I should not wait, I should pay early.

If I wait, I pay £14,488 extra.

500K

The loan is paid off in year 3. I should not wait, I should pay early.

If I wait, I pay £7,653 extra.

1M

The loan is paid off in year 2. I should not wait, I should pay early.

If I wait, I pay £4,851 extra.

2M

The loan is paid off in year 1. This is the point at which 9% of my salary covers all of my student loan. I should not wait, I should pay early.

If I wait, I pay £4,299 extra.

The spreadsheet

https://docs.google.com/spreadsheets/d/1sCHJAbQmc9PBN95tQRPTWCdZ1aAdeKRbZ3VDCDeWGpY/edit?usp=sharing

This is the link to the spreadsheet I made. You can download this to save yourself time creating one yourself.

Input values into the blue boxes and edit where necessary.

Conclusions

What I learn from using this spreadsheet is this:

If I expect to earn above £63K on average then I should pay off my student loan early.

If I expect to earn below £63K on average then I should leave it.

At £92K I really should pay it off early.

It’s important to note that this is an approximation. Real-life is a lot more complicated than that. For a start, most of us will probably not be able to pay off our student loans, in full, immediately after graduating university. Most of us will have salaries that vary over time.

This spreadsheet has to make multiple assumptions and predict 30+ years into the future, so it is by no means accurate. However, it helps to know where ball-park is. Ultimately you have to make that choice: Wait or pay early?